The difference between 1099-MISC vs 1099-NEC lies in how the IRS separates nonemployee compensation from other income types to improve reporting accuracy and reduce filing errors.

Table of Contents

-

Introduction

-

What Are IRS 1099 Forms

-

Why the IRS Split 1099-MISC and 1099-NEC

-

What Is Form 1099-NEC

-

What Is Form 1099-MISC

-

1099-MISC vs 1099-NEC Difference Explained

-

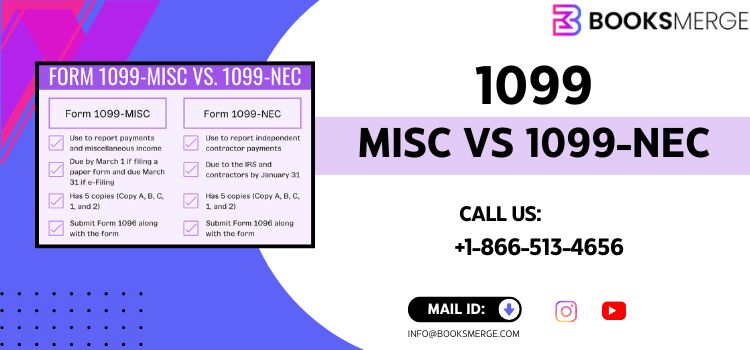

Comparison Table: 1099-MISC vs 1099-NEC

-

When to Use a 1099-MISC vs 1099-NEC

-

Who Gets a 1099-MISC vs 1099-NEC

-

1099-MISC vs 1099-NEC for Attorneys

-

1099-MISC vs 1099-NEC Tax Rate

-

Filing Deadlines and IRS Rules

-

1099-MISC vs 1099-NEC in TurboTax

-

Common Filing Mistakes to Avoid

-

Why Accurate 1099 Filing Matters

-

Conclusion

-

Frequently Asked Questions

Introduction

If tax forms had personalities, the 1099 family would be the confusing cousin everyone avoids at reunions. Among them, the debate around 1099-MISC vs 1099-NEC causes the most headaches.

Many businesses still file the wrong form. Some pay penalties for mistakes they could easily avoid. Others panic because the IRS notices everything. Yes, everything.

This guide clears the confusion using facts, IRS guidance, and plain English. No fluff. No guesswork.

What Are IRS 1099 Forms

The IRS uses Form 1099 to track income that does not come from traditional employment. These forms report payments made to individuals or entities outside your payroll.

Common examples include:

-

Independent contractors

-

Freelancers

-

Attorneys

-

Vendors

-

Property owners

The IRS requires accurate reporting to ensure income transparency. That is where 1099-MISC vs 1099-NEC becomes important.

Source: IRS General Instructions for Certain Information Returns

Why the IRS Split 1099-MISC and 1099-NEC

Before 2020, businesses reported nonemployee compensation on Form 1099-MISC. That system caused frequent errors and late filings.

The IRS introduced Form 1099-NEC to:

-

Separate contractor payments from other income

-

Reduce reporting confusion

-

Improve compliance accuracy

The change simplified enforcement and deadlines. It also reduced excuses like “I thought Box 7 was correct.”

What Is Form 1099-NEC

Form 1099-NEC reports nonemployee compensation. This includes payments to independent contractors for services.

You must file Form 1099-NEC if:

-

You paid $600 or more

-

The payment was for services

-

The worker is not your employee

-

Payment occurred during business operations

Examples include designers, developers, consultants, and freelancers.

Source: IRS Instructions for Form 1099-NEC

What Is Form 1099-MISC

Form 1099-MISC reports miscellaneous income that does not qualify as nonemployee compensation.

Common uses include:

-

Rent payments

-

Royalties

-

Prize and award income

-

Medical and healthcare payments

-

Attorney gross proceeds

Understanding form 1099-misc vs 1099-nec starts with recognizing income type.

Source: IRS Instructions for Form 1099-MISC

1099-MISC vs 1099-NEC Difference Explained

The core difference between 1099-misc vs 1099-nec comes down to purpose.

1099-NEC reports payments for services.

1099-MISC reports other types of income.

Think of it this way. If someone worked for you, use 1099-NEC. If you paid for something else, use 1099-MISC.

Simple logic. Big impact.

Quick Tip: Form 6765 instructions show how to report qualified research expenses to claim the IRS R&D tax credit correctly and avoid filing errors.

When to Use a 1099-MISC vs 1099-NEC

You should file:

-

1099-NEC for service payments to nonemployees

-

1099-MISC for rent, prizes, royalties, or legal settlements

Knowing when to file 1099-misc vs 1099-nec avoids penalties and correction filings.

Who Gets a 1099-MISC vs 1099-NEC

Recipients vary by payment type.

1099-NEC recipients include:

-

Independent contractors

-

Freelancers

-

Consultants

1099-MISC recipients include:

-

Property owners

-

Attorneys receiving gross proceeds

-

Prize winners

Understanding who gets a 1099-misc vs 1099-nec protects both payer and payee.

1099-MISC vs 1099-NEC for Attorneys

Attorney payments confuse many businesses.

Use 1099-NEC for:

-

Attorney fees for services

Use 1099-MISC for:

-

Gross proceeds paid to attorneys

-

Settlement payments

This distinction matters. The IRS checks it closely.

Source: IRS guidance on legal payments

1099-MISC vs 1099-NEC Tax Rate

The forms do not set tax rates. They report income only.

Recipients pay taxes based on:

-

Their filing status

-

Applicable income tax brackets

-

Self employment tax, if applicable

So when people ask about 1099-misc vs 1099-nec tax rate, the answer stays the same. The rate depends on the taxpayer, not the form.

Filing Deadlines and IRS Rules

Deadlines matter more than excuses.

-

1099-NEC: January 31

-

1099-MISC: January 31 for certain boxes, February 28 for others

Late filing leads to penalties. The IRS does not accept “I forgot” as a valid defense.

1099-MISC vs 1099-NEC in TurboTax

TurboTax supports both forms. However, selecting the wrong option causes errors.

Review payment type carefully before choosing. Many 1099-misc vs 1099-nec turbotax mistakes happen due to rushed selections.

Accuracy saves time later.

Common Filing Mistakes to Avoid

Avoid these common errors:

-

Using the wrong form

-

Missing recipient TINs

-

Incorrect payment categorization

-

Late filing

-

Ignoring state requirements

Mistakes increase audit risk and correction costs.

Why Accurate 1099 Filing Matters

Accurate reporting builds trust with:

-

The IRS

-

Contractors

-

Vendors

-

Financial institutions

It also protects your business from penalties and compliance issues.

BooksMerge helps businesses file 1099 forms correctly and on time. Their accounting professionals understand IRS rules and filing nuances.

For expert assistance, contact BooksMerge at +1-866-513-4656.

Conclusion

The confusion around 1099-misc vs 1099-nec ends when you understand one key idea. Services go on 1099-NEC. Other income goes on 1099-MISC.

Following IRS guidance, meeting deadlines, and choosing the correct form protects your business. It also keeps tax season calm, which is rare but possible.

Frequently Asked Questions

What is the difference between 1099-MISC vs 1099-NEC

1099-NEC reports nonemployee compensation, while 1099-MISC reports other types of miscellaneous income.

When to use a 1099-MISC vs 1099-NEC

Use 1099-NEC for service payments and 1099-MISC for rent, royalties, and other non service income.

Who gets a 1099-MISC vs 1099-NEC

Contractors receive 1099-NEC, while landlords and attorneys receiving gross proceeds often receive 1099-MISC.

Are tax rates different for 1099-MISC vs 1099-NEC

No. The forms report income only. Tax rates depend on the recipient’s tax situation.

Can BooksMerge help with 1099 filing

Yes. BooksMerge provides professional 1099 filing support and compliance services. Call +1-866-513-4656 for assistance.

You May Also Visit: Form 6765 Instructions